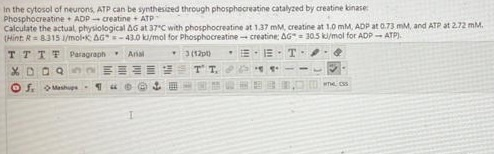

A paypound entrance is a basic piece of a portion life cycle expected by every business merchant. Every business needs to have a portion cycle to engage its clients to make portions; the business similarly needs to ensure that the portion cooperation is essential and invaluable for clients, to overhaul arrangements and pay. What happens between the minutes a client pays you and when you get the portion in your record, the entire course of making and managing the portion is by the portion doorway.

Every merchant needs to have smooth and nonstop trades, yet with a ton of portion organizations available, it becomes testing to pick the best. Other than specific nuances, a business needs to consider the solace level of their clients and select a portion section that directions well with their present stage.

What is a PayPound Entryway?

A portion doorway is a piece of programming that engages a business to recognize online portions from clients. While the majority of portion entries recognize Visas, the more refined ones can arrange a couple of portion procedures, for instance, e-wallets or crypto portions into a singular association point. It streamlines the portion technique and gives an issue-free portion insight for its clients.

Occupation of Gaining Banks and Installment Passages

The firm or seller is related to a getting bank, which grants them to take portions through a portion entryway. Exactly when a client purchases a thing or organization from a merchant, the resources are moved to the transporter’s record with the acquiring bank; the bank or the card patron isn’t associated with the client. The occupation of the portion section is that it interfaces the client to the getting bank and holds the resources until the payout process is done and the resources are put away in the dealer’s monetary equilibrium, which is the acquiring bank. It offers organizations the transporter to get online portions using methods, for instance, Mastercards, check cards, bank moves, and e-wallets.

Portion Handling

The portion dealing with can be applied to the treatment of a portion and is at risk to rules and rules portrayed by portion associations. It is the electronic course of exchanging data and money between the purchaser, the mindful card, the vendor, the portion expert center, and the purchasing bank.

How might everything capacity?

Whenever a buyer appears at the checkout page to make a portion, the trade is begun by a portion section, for instance, PayPound, which is answerable for trade endorsement and encryption of client data to guarantee that it is sent safely all through the cycle.

Following the beginning of the trade, the portion entrance bestows the trade data to the getting bank, who then, at that point, progresses it to the card association (Expert Card, Visa, Find, American Express). Both the capable bank and the card association affirm this information and assurance that the trade is genuine. Expecting the data and trade are real, they attest that the card is genuine and the record related to the card has sufficient resources. The card alliance and giving bank support the trade and send it to the acquiring bank, which henceforth moves the resources for the merchant’s record. All of this happens shockingly quickly, and the client gets the assertion that the portion was made and the trade was done actually.