With the out of work rate skyrocketing and monetary markets in turmoil around the world, practically everyone has actually taken some hits on their credit report. Some have actually gotten it even worse than others. If you find yourself in a bind, if you require some scratch to cover a forgotten costs, if the vehicle has actually chosen it requires a brand-new radiator, or if you simply require some money to tide you over up until payday, you need to think about securing a personal loan for those with bad credit. While having an excellent credit report makes obtaining a lot easier, you can discover lending institutions like slickcashloan who focus on such loans.

Get yourself ready

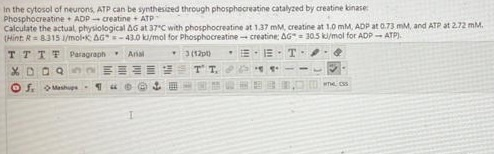

The very first sensible thing to do prior to pursuing your personal loan for those with bad credit is to prepare a budget plan. Lots of personals do not recognize how much they in fact invest each month. You require to note your month-to-month earnings from your task and other sources. You require to make a list of all the commitments you should pay on a month-to-month basis.

Do you have enough left over to make another month-to-month payment? Or, if it is a short-term loan, will you have the wherewithal to pay it off? This is your debt-to-income ratio and it will be what your lending institution will wish to see. It will in fact be more crucial than your credit report. And, while you are at it, you might too get your credit history pulled so you can see simply precisely where you stand. This will provide you the possibility to clean up any incorrect listings. It is not uncommon to discover mistakes.

Get Your Things Ready

Prior to you start your look for an personal loan for those with bad credit, you require to gather some documents. You will most likely require 2 types of recognition acknowledged as legitimate. A driving license, a state recognition card, a military recognition, passport, and so on. You will require evidence of task and income; this could be pay stubs or a number of direct deposit bank declarations.

Lenders like to see a minimum of 3 months on the very same task. You will require a present, legitimate banking account; bank declarations might show this. Lenders choose direct deposit examining accounts so that they can put the loan funds straight into the account. You will require evidence of residency; an energy expense with an address that matches recognition or work records must be sufficient.

Discovering a Personal Loan for Those with Bad Credit

If you have actually been with a credit union or a bank for a substantial duration of time, you might desire to approach them. Their requirements have actually ended up being extremely tight, making it difficult for even those with excellent credit to protect a loan from them. Your best option would be to discover a lending institution online. Point your internet browser to Personal Loans and you will be rewarded with pages filled with lending institutions going to make personal loans for those with bad credit.

Discover 4 or 5 lending institutions who appear to be using the most affordable rates of interest and the comfiest payment terms. You require to examine each of these out by looking in online personal financing online forums. Or, browse the online listings from the Bbb. The BBB grades each loan provider and provides feedback from previous clients.