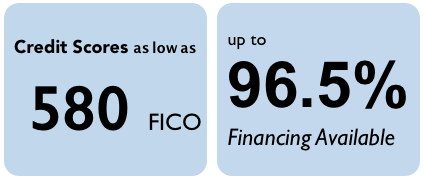

The characteristics of the property influence the release of credit. Homes made of timber, prefabricated houses, vacation homes, farms or farms may be denied funding. This also extends to properties with some legal problem. For the FHA home loan this is important now.

Extra costs

The person concerned should not only worry about the interest and CET rates embedded in the installments, but also about the other expenses surrounding the financing. In doing so, he must also bear the legal appraisal and analysis of the property. They can cost from $ 960 to $ 3,900.

The SFH, Housing Finance System is another monthly fee, permitted by law, charged on this type of loan. It costs around $ 25.00 and can reach $ 9,000 if the funding lasts 30 years. There is still the ITBI, Real Estate Transfer Tax, a rate charged on the value of the property and which depends on the municipality. Usually it equals 2%. This cost exists in any type of property purchase. MIP, Permanent Death and Disability and DFI Physical Property Damage insurance is also required to provide financing. The value of these insurances is calculated monthly and increases with the age of the owner and the price of the property.

Unpredictability

This is a tricky issue, because when you are contracting for a long-term real estate loan, such as a 20-year, it is not just the installments and extra costs that you have to worry about. You need to be aware of any unforeseen issues that may arise and prevent the contract from being fulfilled. And this is due to unforeseen events such as unemployment, other debts and even the deterioration of the property, which will generate additional costs.

In addition, the property does not belong to the owner until he has paid all installments. Until then, the property is alienated to the bank. It is therefore important that the person interested in making this type of loan see if it is worth it. For despite the immediate purchase of the house, there are still interest, maintenance costs, and the possibility of loss due to default and among other issues that should weigh in this choice.

What is the best alternative besides financing?

With all these requirements, financing becomes a very complicated option. In this context, the consortium turns out to be the best alternative to get a property. Unlike the loan, it has no interest rates and other effective costs, only a management fee, which is often much lower. Also, in the consortium there is no entry fee. Your buyer’s financial situation is analyzed when you get the letter of credit in a draw or bid.

We hope this article has helped you understand why it is not worth repaying a loan to buy property. Interested in the possibilities offered by the consortium but have doubts about the operation? So learn more about the consortium market and stay on top.

Do you need urgent money?

Do you want to fund a project, and solve an unforeseen, quickest way? For a long time now, the Spanish financial market has not offered a large fast-paced supply, but for the emerging online loan companies have seen their opportunity in this market. There are now many financial entities willing to offer new online services under different conditions, some bad ones than others.